2017 A Year So Far – Investment Outlook

Investors, managers and commentators have become polarised, with many believing that markets have now entered a new bull phase. Others maintain that the equities have now become overvalued or even in bubble territory and valuations are based on expectations that are unlikely to be realised. The bull argument is founded in a combination of improving global economic fundamentals as well as the expectation that President Trump will deliver pro-growth and pro-business policies which will significantly help US companies. This has resulted is a widening gap between the valuations of US equities and those of the rest of the world. The concern is that these valuations will require the majority of Trump’s policies to be enacted, which many see as unlikely. There has already been some nervousness over the time that it has taken to achieve some of the initial promises. The failure to pass the healthcare bill has been seen as a forewarning to the potential opposition to more economically important policies such as increases in fiscal spending and reduction in regulation.

Nevertheless, there has been a sharp rotation in the market between different investment styles. “Value” companies have performed particularly well against “quality”. This has been driven primarily by rising inflation and the prospect for greater growth. The change has been referred to as the Trump Trade or Trumpflation, as it is assumed that his policies will drive both GDP growth and Inflation. The more positive sentiment has resulted in very low levels of volatility.

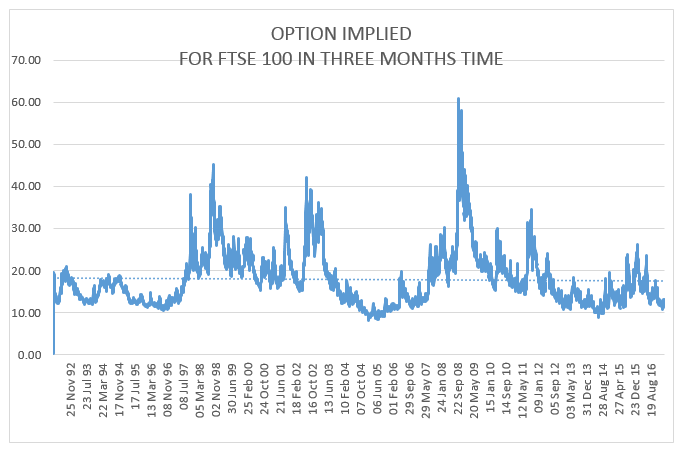

The graph indicates that the market is trading at a level of volatility consistent with other lows in the index. While this can remain low for some time it is very likely to increase significantly over the medium term.

The improving economic outlook is difficult to deny, and most agree that the world economy is in a better place than it has been over the last couple of years. The fears of the US recession last year are now well forgotten. Global PMI readings are now significantly better than they were, and importantly the Chinese stimulus enacted last year is appearing to have an impact.

The increase in the oil price as well as the wider commodity market has begun to impact inflation readings globally. UK inflation is now running at 2.3%, with Europe and the US at a similar level. This has encouraged policy markets to tighten (or at least to signal tightening) monetary policy. The Federal Reserve has increased rates again in March and the Bank of England has hinted that they have begun to think about a hike. The European Central Bank has indicated that they are likely to taper the current QE programme and/or increase interest rates if the current path on Eurozone growth/inflation/employment continues. The one policy target of the ECB is to maintain inflation “just below” 2%. The current Eurozone inflation rate is 1.9%.

There is still a high level of political uncertainty, although investors appear to be taking this into account less and less. The failure of the populist Dutch politician Geert Wilders to secure victory in the general election was seen as a positive for the Eurozone and marks one less potential political upset in the 2017 calendar. However, the upcoming French presidential election and the German general election later in the year have the potential to create volatility. While there is a possibility of Marine Le Pen gaining power, her ability to break away from the Eurozone and set up a separate currency or call an EU referendum is limited. Her victory would likely be greeted with a wide selloff in European securities and French bonds, however, this could be seen as a buying opportunity.

The Brexit process has now begun with the triggering of article 50 on 29th March. It has been highly publicised and is unlikely to warrant significant market reaction. However, the announcement of a snap General Election for June has come as a surprise, but while the news has shaken markets the result should give the winning party a clear mandate going in to negotiations hopefully reducing volatility. The commencement of negotiations is likely to start a news stream of potential policies which may unsettle parts of the market. The highly unpredictable nature of this news flow makes positioning an investment portfolio difficult, however, opportunity may come from any turmoil.

Fixed income markets have been buffeted by monetary policy decisions and changing inflation forecasts, however, they remain broadly at the same level they were three months ago. Credit spreads have tightened slightly as the confidence in the economy has improved.

The oil market had been relatively steady throughout the last three months, however, concerns over the speed of American production coming back on stream has surprised speculators that thought OPEC cuts would resolve the supply/demand imbalance. It is reasonable to expect that oil will continue to trade in the $45-60 range without significant changes in the current outlook. This would therefore not have a major impact on inflation/gdp.